What Does Short Term Loan Do?

Table of ContentsShort Term Loan Things To Know Before You Get ThisThe Best Guide To Short Term LoanAn Unbiased View of Short Term LoanGetting The Short Term Loan To WorkThe Short Term Loan IdeasThe 2-Minute Rule for Short Term Loan

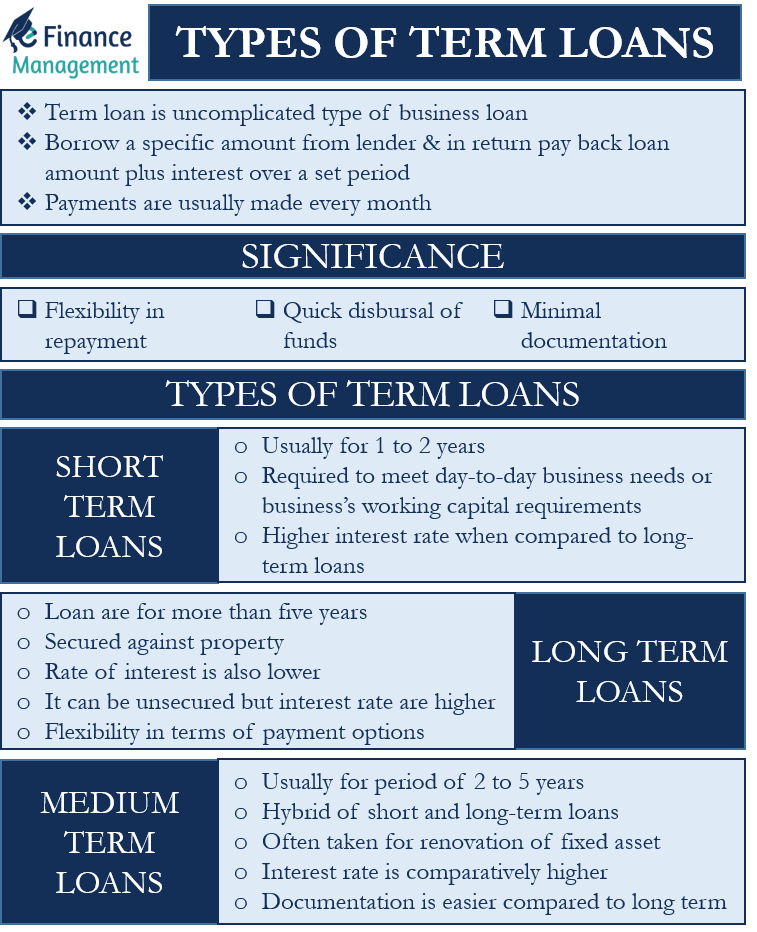

In scenarios like these, many individuals turn to short term lendings or short-term financing as a way to pay for unanticipated or challenging personal costs. Short-term financing is a car loan alternative that provides the recipient obtained funds for temporary costs, comparable to just how a short-term financing works!.?.!? Short term loans provide you obtained resources that you repay, plus interest, typically within a year or much less.A massive advantage of short term funding is that they can make a big difference for people who require prompt accessibility to cash they don't have. Short term funding lending institutions do not place a huge emphasis on your credit report for approval. More vital is evidence of employment as well as a consistent revenue, information about your bank account, and showing that you do not have any type of impressive loans.

Several kinds of short-term lendings deal impressive flexibility, which is useful if money is tight now yet you prepare for points improving economically soon. Before authorizing for your short-term loan, you and the lending institution will certainly make a timetable for repayments as well as agree to the interest prices up front.

Getting The Short Term Loan To Work

The advantage of temporary financing is that you obtain a relatively tiny amount of cash right now, and you pay it back swiftly (Short term loan). The total rate of interest repaid will normally be much less than on a bigger, lasting funding that has even more time for interest to construct. No financial option is excellent for each consumer.

This is why it is necessary to consider your alternatives in order to set yourself up for success. Have a look at the three top downsides of securing a short term lending. The biggest downside to a temporary funding is the rates of interest, which is higheroften a great deal higherthan rates of interest for longer-term car loans.

The Greatest Guide To Short Term Loan

In addition to paying back the short-term funding equilibrium, the rate of interest repayments can result in higher payments every month (Short term loan). However, maintain in mind that with a temporary financing, you'll be repaying the loan provider within a short period of timewhich methods you'll be paying the high passion for a much shorter time than with a long-term try these out financing.

Lasting financings might have lower rate of interest, yet you'll be paying them over numerous years. So, depending upon your terms, a short-term loan might really be cheaper in the lengthy run. While paying back a brief term finance in a timely manner according to your set timetable can be a considerable increase to your credit report, failing to do so can trigger it to drop.

This can be harmful if you just have a little or good credit background, and also devastating to your future capacity to obtain if you currently have poor credit. Before obtaining a brief term car loan, be straightforward with on your own about your ability as well as technique when it comes to paying back the funding in a timely manner.

Getting My Short Term Loan To Work

There are several benefits and also drawbacks of short-term financing. Thinking about the top advantages and also negative aspects of short-term financings will certainly aid you determine if this economic tool is best for your situation. If you have any even more inquiries, be sure to get in touch with Power Finance Texas today!.

? .!!. A short-term loan is a lending that the borrower requires to pay back, along with passion, in a reasonably short period, normally in a year. The borrower returns the amount of the financing to the lender over the course of months as opposed to years. If you are in urgent demand of funds to fund a purchase, you can easily obtain a financing either online or with a financial institution or cooperative credit union.

The demands for looking for click to read a funding are: The borrower ought to be 18 years or over Legitimate email address as well as contact number Although these are a few of the demands that you might need to satisfy prior to looking for a loan, you don't require to have security while getting a car loan.

Indicators on Short Term Loan You Should Know

There are numerous advantages linked with short-term financings. Let's discuss them to aid you recognize exactly how beneficial these car loans can be.

With short-term car loans, you additionally get aid in boosting your credit ranking. As you are making an application for a temporary funding, you should be certain sufficient to settle it in the needed duration. Users of temporary financings commonly gain lines of credit rating. One of the most attractive as well as beneficial function of temporary car loans is that they supply flexibility as well as convenience.

Some Known Questions About Short Term Loan.

Numerous loan providers run web sites that you can check out straight to make an application for a funding promptly. Provided that you have to repay the car loan within a brief period, the anxiety related to settling it will certainly not last for long! These are all the benefits that short-term lendings offer. If you remain in immediate requirement of Discover More Here money, what are you waiting for? Go and request the financing to acquire its benefits.

You can merely request a car loan and settle it as quickly as you earn sufficient profit.